- Platform

Platforms

- Solutions

- Industries

Industries

- Why FortifyData

Why FortifyData

"This is an excellent starting point for any organization that wants to get serious about their cyber risk management. The system has the capability to grow as you become more sophisticated in your use"

IT Director

Services Industry - Company

Company

- Partners

Partners

- Resources

Resources

Reduce Cyber Risk for Financial Services Organizations

Financial services institutions top the list when it comes to targets for cybercriminals. Not only do they have access to trillions of dollars, but they are also responsible for storing and transmitting highly critical and valuable data. Security teams at these organizations face the difficult task of weaving in security with innovation and customer convenience, as many customers prefer to do their banking and other financial transactions online.

Aside from worrisome cyber exposures, the financial sector is also highly regulated, so complying with multiple regulations is also a top concern. Bottom line, CISOs at financial institutions must juggle multiple priorities all while aligning cybersecurity with business goals.

Manage Cyber Risk and Compliance in One Comprehensive Platform

FortifyData’s platform helps financial institutions manage their cyber risk and regulatory compliance programs. FortifyData enables these organizations to continuously identify assets, view and manage risks across multiple locations, perform third party risk management of vendors that serve the entire institution or only specific departments. Also, manage the applicable regulatory compliance (FFIEC, PCI DSS, GLBA, ISO 27001, GDPR, NYCRR, etc.) and questionnaire processes. FortifyData takes all this into account and can also provide a security rating for the entire financial system or specific branches.

Why Financial Institutions Choose FortifyData

- We work with a variety of financial institutions, banks, credit unions, mortgage lenders, private equity, venture capital, payment processors and more

- FortifyData provides a holistic view of cyber risk across the financial institution with the ability to drill down into specific assets

- Prioritized view of risks with recommended remediation steps for identified vulnerabilities

- The accuracy of our risk assessment findings is based on continuous, direct, assessments of the financial institution’s assets, services and processes that provide an up-to-date view of cyber risk

- Monitor cyber risk management progress compared to other financial institutions

- FortifyData has been working with banks, credit unions, mortgage lenders, insurers and other financial services companies across the Nation to more accurately understand their cyber risk exposure of external, internal, cloud and third parties.

Banks

Credit Unions

Lenders

Investment Companies

Insurance Companies

Banks

Cyber criminals tend to go where large pools of sensitive information and money are, making banks a top target. Global regulations are increasing, maintaining customer trust is a top initiative, banking institutions must be able to discover and remediate cyber threats, including those from their third-party ecosystem, that can jeopardize these. These cyber exposures, plus compliance regulations are the top two concerns at both small and large banks, according to a study from Deloitte, and FortifyData can help you with both.

The FortifyData platform continuously identifies assets and vulnerabilities, allows you to view and manage risks across multiple locations, and performs third party risk management of vendors that serve the entire institution or only specific departments or branches. We also enable the management of questionnaires and compliance regulations specific to your needs.

Credit Unions

Cybersecurity risks continue to be a critical concern for credit unions and they are increasingly subject to ransomware, malware and phishing attacks, denial of service attacks, ATM skimming, and supply chain attacks. Compounding the situation is the cybersecurity talent shortage. Now, smaller teams are having to deal with a heavier workload, making it even more difficult to identify and manage cybersecurity risk.

FortifyData provides a comprehensive platform to manage and continuously monitor your organizational and third-party cyber risk. Our platform makes it easy for credit unions to get an accurate and complete view of their cyber risks, along with actionable data and recommendations for remediation. The platform also enables credit unions to meet certain requirements of various compliance frameworks for cyber risk management, assessments, vulnerability management and third-party risk management.

Lenders

Cyber risk is a top concern for lending providers, which rely heavily on technology, have an expansive third-party network, and must collect, manage, store and transmit highly sensitive data – making them a top target for cybercriminals.

FortifyData works with lending companies to measure and manage their own cyber risk, as well as the cyber risk of their vendors and third parties. Our platform makes it easy to uncover top threats and risks, understand the risk that vendors may pose to their security posture, and quantify the financial impact of their cyber risk. Because much of the work in the lending industry is done through email, FortifyData also provides an email security capability that assesses email security for all domains tied to a company including SPF, DKIM and DMARC issues.

Investment Companies

The ability to accurately assess cyber risk exposure and the financial impact of potential and existing investments, including how to protect them, is vital in assuring a cyber incident does not affect the value of the acquisition or introduce cyber liabilities to the acquiring organization.

With FortifyData’s automated cyber risk assessment and financial quantification capabilities, acquiring organizations can understand the cyber risks of the targeted companies that may be introduced into the business and financial investment firms can easily see how their investments fare individually and as a group, enabling them to identify and aggregate risk in ways that help prevent and protect their portfolio from unseen risk.

Insurance Companies

FortifyData can help insurance companies accurately assess cyber risk exposure and the financial impact of cyber risks for themselves, applicants seeking coverage and third parties to better understand any cyber liabilities that may exist. You will get a prioritized view of risks with recommended remediation steps for any identified vulnerabilities, and for companies applying for cyber liability insurance you’ll get an accurate view of their cyber risk exposure based on live, direct assessments of their systems which can help reduce future claims payments.

Further, if your organization offers cyber liability insurance, FortifyData’s automated cyber risk assessment and financial quantification capabilities, allow you to determine how much cyber liability coverage an organization needs, or if they are over or under insured.

Solutions for Financial Services Institutions

Attack Surface Management and Risk-based Vulnerability Management

Starting with asset discovery and inventory, our Attack Surface Management (ASM) identifies your financial institution’s IT assets as an attacker will. FortifyData assesses all ports and services of a financial services company’s external and internal attack surface and identifies the same vulnerabilities an attacker would. Our prioritization capabilities help you cut through the noise and get a view of the vulnerabilities with the most impact that actually matters; you can view this across the entire company or by specific branch or department. You get a prioritized risk approach that considers context through asset classification, threat likelihood, and business impact, so you know where to focus time and resources on the most critical vulnerabilities to your organization.

Managing Compliance, Improving Reporting and Communication

FortifyData’s automated platform helps to streamline aspects of the compliance monitoring and reporting activities. The platform helps a financial institution to meet certain requirements of various compliance frameworks for cyber risk management, assessments, vulnerability management and third-party risk management.

Additionally, reporting from the FortifyData platform provides easy to understand reports with underlying detail to better report and communicate compliance management with stakeholders.

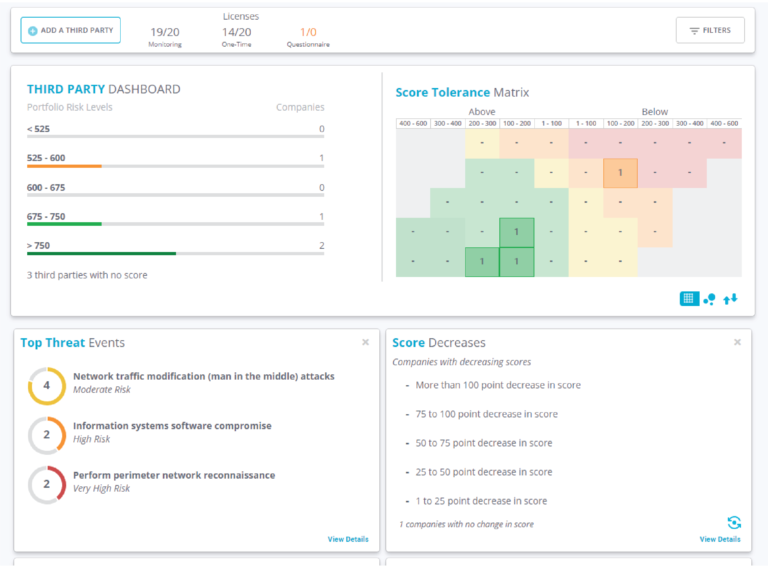

Third-Party Cyber Risk Management

Effectively evaluate a vendor and the specific service or product a vendor provides.

Gain visibility into third party cyber risks with continuous assessments of their external assets. We integrate our technology assessment findings to our embedded standard compliance or custom questionnaires to perform auto-validation that saves time in reviewing responses. Keep up to date on the compliance of your suppliers with your policies, and quickly identify vendors that do not comply. Get the full picture of external vulnerabilities at your third parties with our auto-validated questionnaires that leverage the live assessment data conducted on their environment. This provides you with the answers you need more quickly (in the time to run an assessment) than a manual questionnaire process. Create custom questionnaires that are specific to each vendor. Easily assign tasks and collaborate and track questionnaires with our task management capabilities.

Speed up vendor evaluations by spending less time reviewing questionnaires with FortifyData’s Questionnaire Exchange. Participants instantly access shared validated cyber risk assessments and questionnaires, allowing you to quickly make risk based decisions.