- Platform

Platforms

- Solutions

- Industries

Industries

- Why FortifyData

Why FortifyData

"This is an excellent starting point for any organization that wants to get serious about their cyber risk management. The system has the capability to grow as you become more sophisticated in your use"

IT Director

Services Industry - Company

Company

- Partners

Partners

- Resources

Resources

Cyber Risk Quantification

Cyber Risk Quantification (CRQ) Translates Cybersecurity Risk to Budgetary and Management Language

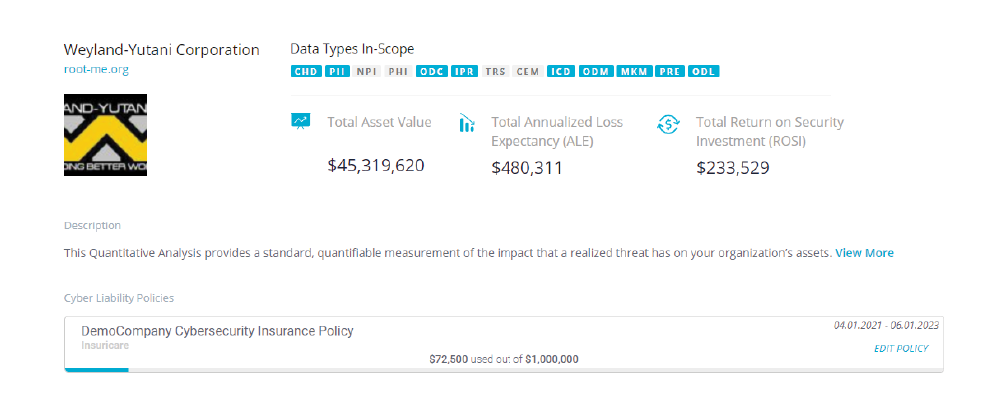

FortifyData assessments create an inventory of the IT assets and processes for an organization. This asset information can be classified and analyzed by FortifyData’s Cyber Risk Quantification module to calculate the business impact of cyber risk and helps calculate financial scenarios such as Annualized Loss Expectancy (ALE), cyber insurance diligence, budgetary justification and measuring the security program. These financial scenarios help to understand the cyber risk to the business so leaders can make decisions on transferring the risk, mitigating the risk and aligning management and cybersecurity leaders to manage the remaining risk.

Calculate Annualized Loss Expectancy

Quickly and easily assess the financial exposure of your organization so you can communicate cyber risk in a language that makes sense to the business. FortifyData makes it easy to analyze and report on the financial impact of different risk scenarios, using the widely recognized Annualized Loss Expectancy (ALE) Model.

Cyber Liability Insurance

FortifyData’s Financial Quantification module allows you to determine how much cyber liability coverage your organization needs, or if you are over or under insured. You can input your policy coverage amounts, the dates the policy is effective, and the insurance provider for all your different policies.

eBook: How to Get Lower Cyber Insurance Premiums

Understand the stricter standards that have been put in place, as well as the process that insurance companies use to determine who they cover and how much coverage they will receive, so that you can get lower cyber insurance premiums.

Financial Cyber Risk Quantification with FortifyData

Learn all about the Financial Risk Quantification Module within the FortifyData platform, and see why organizations are using it to gain visibility into the cyber risk of their enterprise and their third parties.