The Future of TPRM:

From Process Management to Autonomous Risk Intelligence

For years, third-party risk management has been defined by manual effort, periodic assessments, and an uncomfortable tradeoff between speed and confidence.

- Security teams chase questionnaires.

- Vendors respond with static documents.

- Risk is assessed at a moment in time, then quickly becomes outdated.

Even as tools have improved, the core operating model of TPRM has remained stubbornly human-driven and reactive.

That model is nearing its end.

Looking ahead, the evolution of TPRM points toward a fundamentally different future one that is largely autonomous, continuously operating, and intelligence-driven. In this future state, third-party risk management is no longer a workflow teams manage, but a system that manages itself.

At the center of this transformation is AI.

In an AI-powered TPRM world, organizations deploy intelligent risk agents that operate on their behalf. These agents understand the organization deeply its industry context, regulatory obligations, data sensitivity, operational dependencies, and risk tolerance.

Whether the organization operates in financial services, healthcare, higher education, or critical infrastructure, the agent carries that context into every risk interaction automatically.

When evaluating a potential or existing third-party vendor, these agents no longer begin with a questionnaire.

Instead, they communicate directly with the vendor’s trust center or assurance agent through secure, interoperable mechanisms. Policies, certifications, audit reports, penetration test summaries, resilience attestations, and control mappings are exchanged agent-to-agent in real time.

AI-powered vendor risk assessment begins.

Information is validated at the source, evaluated for relevance and freshness, and mapped directly against the organization’s regulatory and internal requirements without human intervention.

Redundancy disappears. Vendor fatigue declines. Accuracy improves.

Crucially, this interaction is not generic. The requesting agent negotiates precise access—only what is required based on the organization’s risk profile, contractual needs, and applicable regulations. If a vendor handles regulated data, supports mission-critical operations, or introduces systemic risk, the depth of review automatically increases. If the vendor is low-risk, the assessment remains lightweight and efficient.

When gaps emerge outdated artifacts, missing controls, inconsistent claims the system does not escalate everything to a human. Instead, the agent issues targeted, contextual follow-up requests that are specific, defensible, and proportional to the risk. Humans are engaged only when judgment, approval, or accountability is required.

This is what near-autonomous TPRM looks like.

Risk assessments are no longer quarterly or annual events. They are continuous. Risk signals from trust centers, attack surface intelligence, incident disclosures, regulatory changes, and operational metrics are correlated in real time. Vendor risk scores evolve dynamically, not on spreadsheets or dashboards waiting for manual updates, but as living representations of exposure.

Importantly, autonomy does not mean opacity.

Every AI-driven action is explainable, auditable, and governed. Decisions are logged. Evidence is traceable. Human-in-the-loop controls exist where regulation, contracts, or material risk demand it. The system accelerates work but accountability remains human.

The outcome is not just efficiency. It is a stronger, more resilient supply chain.

Organizations move from chasing compliance to continuously validating trust. Security teams stop managing processes and start making decisions. Vendors engage through standardized, intelligent channels instead of repetitive questionnaires. And risk—once lagging behind the business—moves at the speed of the ecosystem it protects.

This is where TPRM is going.

Not incremental automation.

Not better questionnaires.

But a future where third-party risk management is largely autonomous, continuously aware, and designed for the scale and complexity of modern digital supply chains.

And the organizations that embrace this shift early will not just manage risk better—they will operate with confidence others cannot match.

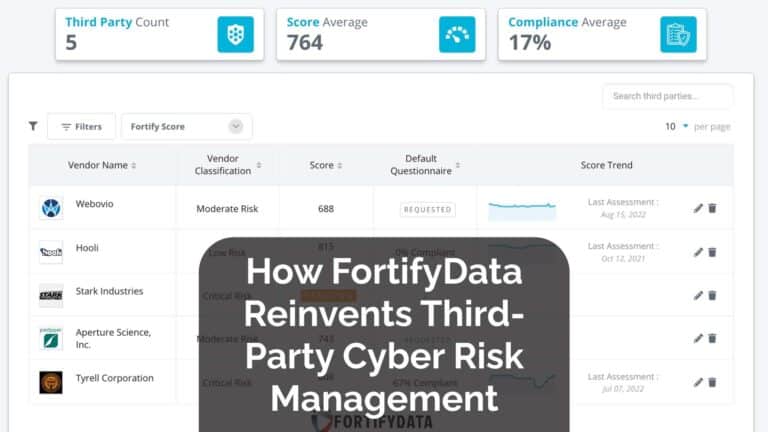

This is precisely why FortifyData is taking intentional steps toward agentic, AI-powered vendor risk assessment workflows.

We are already delivering time and efficiency savings to clients with our AI Auditor of vendor reports (video at the top), which can be intelligently compared to other frameworks.

Our next effort automates the due diligence lifecycle to reduce the administrative burden of requesting information, initiating a custom questionnaire addressing gaps, evaluating provided evidence for an efficient risk decision.

We believe the future of TPRM is not another layer of tooling, but a fundamentally new operating model one where intelligent agents execute risk workflows end-to-end, continuously and contextually, while humans retain oversight where it matters most.

By building agentic workflows into the core of the platform, FortifyData is laying the foundation for autonomous risk operations that scale with the modern enterprise, reduce friction across the vendor ecosystem, and deliver real-time, defensible confidence in third-party relationships. This is not a distant vision; it is the direction we are actively designing toward and acting on today.

Related Posts